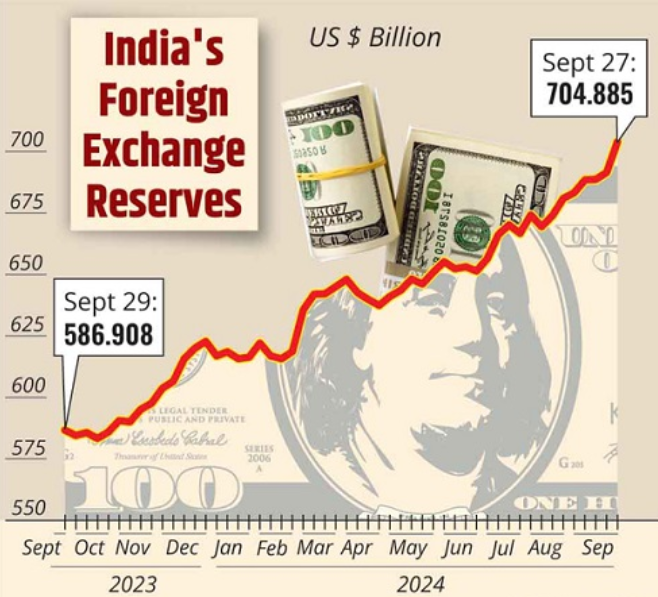

India’s foreign exchange reserves have surpassed $700 billion for the first time, reaching $704.89 billion for the week ending September 27. This increase of $12.59 billion marks one of the largest weekly rises since mid-July 2023, as reported by the Reserve Bank of India (RBI).

- Foreign Currency Assets: Foreign currency assets rose by $10.4 billion to a total of $616 billion, reflecting the impact of currency fluctuations.

- Gold Reserves: Gold reserves increased by $2 billion, reaching $65.7 billion.

- Special Drawing Rights (SDRs): SDRs saw a modest increase of $8 million, now standing at $18.547 billion.

- IMF Reserve Position: India’s reserve position with the IMF fell by $71 million to $4.3 billion.

Factors Driving the Rise in Reserves

The surge in forex reserves can be attributed to a combination of factors:

- Dollar Purchases by the RBI: The RBI’s proactive dollar purchases amounted to $4.8 billion.

- Valuation Gains: An additional $7.8 billion in valuation gains resulted from declining U.S. Treasury yields, a weakening dollar, and rising gold prices.

- Foreign Inflows: Year-to-date foreign inflows have reached approximately $30 billion, primarily driven by investments in local debt following India’s inclusion in a significant J.P. Morgan index.

Economic Context and Historical Trends

India has been steadily building its forex reserves since 2013, a response to earlier capital outflows amid weak economic fundamentals. Improved fiscal discipline, effective inflation control, and robust economic growth have led to increased foreign capital inflows.

Future Outlook for Forex Reserves

Projections from Bank of America suggest that India’s forex reserves could reach $745 billion by March 2026. This growth will provide the RBI with greater flexibility in managing the rupee’s valuation in the global currency markets.

Conclusion: A Stronger Economic Position

The crossing of the $700 billion threshold in forex reserves reflects India’s strong economic fundamentals and effective monetary policy. As the country continues to attract foreign investments, maintaining and managing these reserves will be crucial for sustaining growth and stability in the global economic landscape.